Finance Case Study: Illscape Studios 2025 Cash-Flow Execution Toward October 2026 Break-Even

Overview

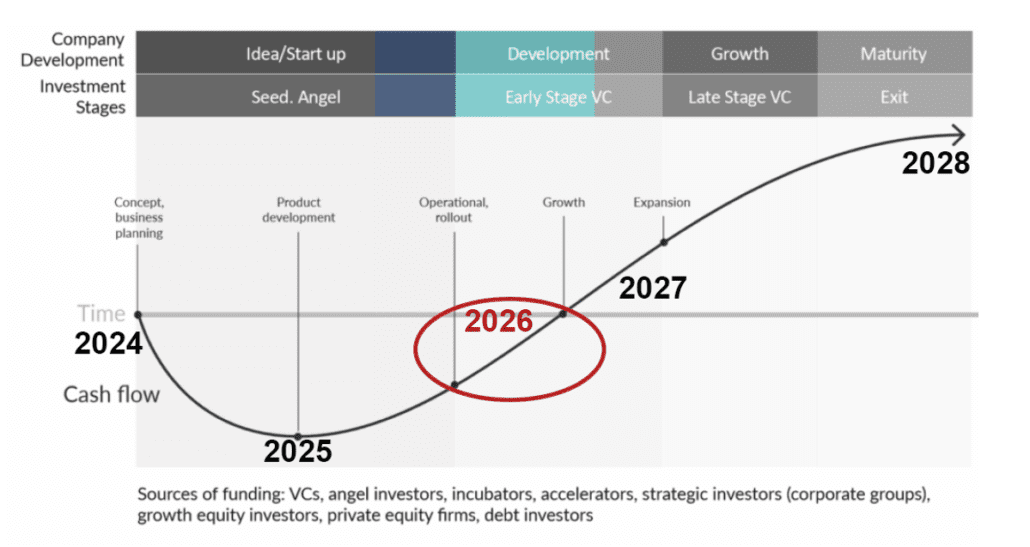

Illscape Studios launched as a new operating entity with a deliberate cash-flow focus. Leadership assumed a J-curve pattern, with delayed profitability, and treated 2025 as a year to build financial momentum rather than focus on net profit. Kenton defines a J-curve as an early-loss pattern followed by a later rise in performance, often used in turnaround or private-equity contexts.

Illscape executed four live events in 2025. Leadership tracked money movement through deposits, vendor payments, production spending, and post-event collections. Across 2025, Illscape generated approximately $40,000 in revenue from ticket sales and business plan writing, while still operating at a loss. Leadership expects to break even in October 2026. For 2026, Illscape plans eight live events and forecasts roughly double 2025 revenue, driven by event volume and process repetition.

Starting Constraints

Illscape faced common early-stage constraints. Operating systems require upfront spend. Event production required cash before doors opened. Marketing requires spending before conversion. Vendor payments and artist deposits often require early payment.

Churchill and Mullins warn that growth consumes cash, and profitable firms still risk running out of cash if growth outpaces working-capital capacity. Illscape treated the risk of running out of cash due to timing gaps between spending and collection as a core operating issue.

Bootstrapping & Owner Capital

Illscape used bootstrapping in 2025. Owners contributed capital to cover early deposits and timing gaps. These funds supported liquidity while operating systems matured.

Owner contributions were recorded as owner equity rather than operating revenue. They did not inflate income or profit. They appeared on the balance sheet as paid-in capital and on the cash flow statement as financing activity.

This distinction mattered. The reported 40k reflects only customer-paid operating revenue. Owner capital supported execution, but did not generate revenue.

Strategy: Manage Velocity, Not Net Income

Illscape structured 2025 around cash velocity and working-capital control.

Key principles:

- Treat each event as a cash cycle.

- Pull cash forward via pre-commitment.

- Push cash out later when terms allow.

- Measure time between cash outflow and cash inflow for each event cycle.

Hayes describes the cash conversion cycle as the time required for a firm to sell, collect, and pay bills. Shorter cycles keep cash tied up for fewer days. Illscape applied the logic of the cash conversion cycle to event operations and artist solutions, even in the absence of inventory.

Execution in 2025

Illscape executed four events with a consistent operating posture.

Operational moves used in each cycle:

- Prioritize deposits and advance sales where possible, to reduce front-loaded production exposure.

- Stage spending by milestone, tied to confirmed revenue.

- Maintain visibility into near-term obligations such as venue settlements, contractor labor, and marketing spend.

- Use basic financial statements as management tools, not only compliance tools.

The U.S. Small Business Administration frames the balance sheet as a foundation for tracking capital and supporting cash flow projections. Illscape used the approach of treating financial statements as management tools rather than compliance documents to keep operational decisions tied to liquidity and obligations.

Results in 2025

Illscape’s cash-flow posture correlated with revenue generation.

Outcomes reported for 2025:

- Four live events executed.

- Around $40,000 generated across the year.

- Business remained below break-even.

- Access to small loans occurred during this period, helping to build business credit.

Loan access aligned with lender preference for demonstrated revenue activity, controlled obligations, and repeatable collections. Illscape’s approach produced a visible pattern of inflows and outflows tied to deliverable work.

Why the Model Produced Revenue before Break-Even

Illscape’s approach shifted behavior. Cash-flow thinking pushed earlier offers, earlier invoicing, clearer terms, and tighter operating discipline. Churchill and Mullins emphasize balancing cash consumption and cash generation during growth phases. Illscape treated each event cycle as a unit of operating performance and improved repeatability across cycles.

Why Loan Access occurred Pre-Break-Even

Lenders underwrite repayment capacity, not narratives. Illscape demonstrated:

- Repeated inflows tied to real activity

- Predictable event-based revenue cycles

- Controlled outflows and staged spending

- Owner equity supporting liquidity

Net profit was not the deciding factor. Movement and consistency mattered more at this stage. Illscape showed that cash entered the business reliably and exited with discipline.

2026 Plan and Break-Even Target

Illscape plans eight live events in 2026. Leadership forecasts roughly double 2025 revenue based on event count and repeatable systems. Break-even remains projected for October 2026. Leadership views break-even as an operational milestone driven by increased event throughput, improved unit economics, and tighter cash conversion cycles.

References

Churchill, N. & Mullins, J. (2001). How Fast Can Your Company Afford to Grow? Harvard Business Review.

Hayes, A. (2025). What is the Cash Conversion Cycle (CCC)? Investopedia.

Kenton, W. (2025). J-Curve: Definition and Uses in Economics and Private Equity. Investopedia.

U.S. Small Business Administration (2025). Manage Your Finances.